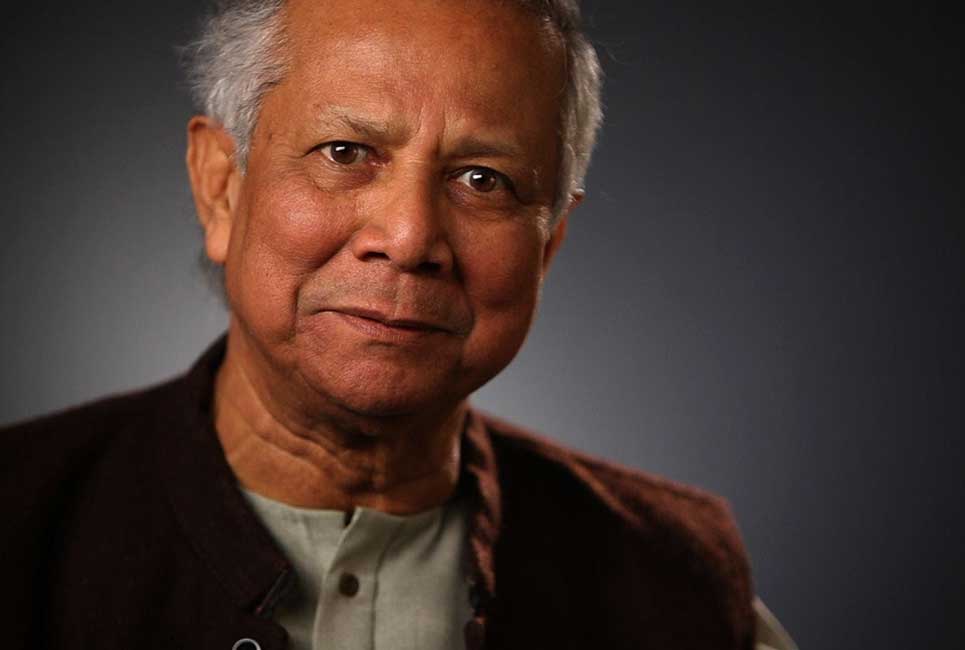

Socioeconomic class mobility directly correlates with one’s ability to obtain and receive loans. Although poverty can be escaped through education, the systemic institutions in place in many countries greatly hinder social mobility; even those who may get outstanding educations sometimes lack the connections to capitalize on their educations. Another, more effective way to climb the socioeconomic ladder, however, is through entrepreneurship — it has been proven that “entrepreneurs experience higher upward mobility than workers”. It was with this idea in mind that Muhammad Yunus changed the economic system.

“My greatest challenge has been to change the mindset of people. Mindsets play strange tricks on us. We see things the way our minds have instructed our eyes to see.”

Enter Muhammad Yunus, Revolutionary Social Entrepreneur

Muhammad Yunus recognized that this created a unique problem for a large percentage of the world’s population, which lacks necessary access to traditional bank loans that would enable social mobility through entrepreneurship.

Muhammad Yunus decided to change that. He founded the Grameen Bank, an organization that operates in Bangladesh. The Grameen Bank operates on Yunus’s idea that ”these millions of small people with their millions of small pursuits can add up to create the biggest development wonder.” Microfinance changes lives for the better.

What is Microfinance?

Until recently, the ability to gain a loan was predicated on your existing wealth, or at least the amount of capital that could be borrowed against. This meant that very few individuals had access to the kinds of opportunities that would allow them to start their own businesses, or gain a leg up for the businesses they may already own. The concept of microfinance did not exist. Microfinance includes the financial services, loans, and opportunities that are available to those without collateral. While the loan terms are often shorter than traditional loans, the amounts are far less as well.

Why Does Microfinance Matter?

Microfinance changes communities. It works to provide opportunities to small-time players in a big-time game. Microfinance changes lives as well; a small loan like those given by the Grameen Bank allow borrowers to invest in their lives. These little loans can make a very large difference, especially to those with small businesses.

For example, you may have a wonderful hand-made product that sells out as fast as you can make it. Due to constraints out of your control, because you still have a family to take care of and need to sleep at some point during the day, you cannot produce extra of this product to market on a larger scale. Thus, you can only produce these goods as quickly as you can work. This limits your earning potential and restricts your market. What can a microloan do for you?

Several things. Microfinance could give you enough initial money to hire another employee. It could provide childcare, or hire a helping hand around the house so you are freer to produce a product. Depending on what you’re producing, it could potentially pay for a machine that allows certain steps of your product to happen quicker. Say your first loan works, and you now have more product. You know of a market a short distance away, but it’s too far to get there with the transportation available to you. Another microloan could pay for that transportation, which would increase your market further, expanding your business.

“Business is a very beautiful mechanism to solve problems, but we never use it for that purpose. We only use it to make money. It satisfies our selfish interest but not our collective interest.”

Who Uses Microfinance the Most?

Microfinance is especially important in developing countries, where access to opportunities like starting your own business often only exists for those who already have the existing capital to do so. The Grameen Bank has been especially important for women: 97% of their borrowers are women. This matters because it allows households to become a two-income family, especially in areas where women may not be culturally able to work or have other constraints. Often, these loans go towards education, housing, or even healthcare, in addition to business growth efforts.

However, microfinance is growing in importance in developed countries as well. In the United States, microfinance works to provide a means for small businesses and economically disadvantaged people to gain economic independence and graduate from welfare programs or other forms of government assistance. Without microcredit loans, a large swath of the American public would be unable to escape the grasps of poverty.

What are your thoughts about microfinance? Leave us a comment!

You might also enjoy: